The Different Forms of Payment Processing with BlueSnap

‘BlueSnap ’ is the term used for a payment processing solution just about everywhere you look. Nearly every ecommerce site, software-as-a-service provider, and content distributor you can find uses BlueSnap for this purpose. Payment processing is an invaluable tool for any business accepting money from customers and partners; without it, profits could not be collected.

What Is Payment Processing?

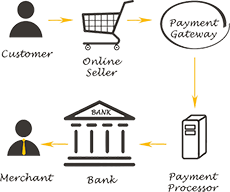

Payment processing is the process by which payments are collected online before they are accepted into the customer’s account. This includes capturing the payment information, verifying it, and then depositing it into the merchant’s bank account. It’s the bridge between the customer and the merchant in an electronic transaction.

The process is relatively simple but also very important. Payment processors make sure that the customer’s funds are safe, secure, and handled as efficiently as possible. Furthermore, they ensure that companies comply with all applicable regulations, including data security standards and fraud prevention procedures.

Types of Payment Processors

There are two main types of payment processors: those that handle all aspects of the payment process and those that specialize in certain aspects. The former option is referred to as an “all-in-one” payment processor, such as BlueSnap. These services collect and store customer financial information, facilitate transactions, and handle all associated fees.

Specialized payment processors are designed to focus on specific areas. For example, there are services that only handle credit card processing, others that handle ACH transfers, and others focused solely on recurring billing. Depending on the size of your business and the amount of transactions you process, one type may be more beneficial than the other.

Advantages of Payment Processing with BlueSnap

When you use BlueSnap, there are several advantages that you will enjoy. Firstly, they provide an easy way to accept payments from global customers. BlueSnap offers support for payment methods from over 180 countries, allowing you to expand your business operations to different markets.

Also, BlueSnap has advanced fraud protection features and a low chargeback rate. Their secure checkout options offer superior protection against fraudulent transactions, while their technology helps reduce the chances of a chargeback. Additionally, their customer service team is available 24/7 to answer any questions or concerns you have.

Downsides of Payment Processing with BlueSnap

While BlueSnap offers many advantages, there are some disadvantages to keep in mind. First, their fees can be high. BlueSnap charges both setup and processing fees, which can add up if you accept a lot of payments. Secondly, their customer service team can take some time to respond to inquiries, so it’s best to plan ahead for any potential issues.

Finally, BlueSnap does not guarantee a successful payment straight away. Funds need to be returned within three days after the initial payment was made. So, if the customer’s financial institution takes longer to process the payment, it might not be received in a timely manner.

Key Takeaways

Payment processing is a critical function for businesses that accept payments from customers and partners. ‘BlueSnap’ is a well-known payment processor that provides a streamlined solution for collecting payment information, verifying it, and depositing it into the merchant’s bank account. Specialized payment processors can be beneficial depending on the volume of transactions you handle.

BlueSnap offers many advantages, including global payment acceptance, fraud protection measures, and 24/7 customer service. However, their fees can be high, their response times can be slow, and they cannot guarantee a successful payment right away.